In the fast-paced world of healthcare, effective accounts receivable (A/R) management is crucial for maximizing revenue and ensuring financial stability. As healthcare organizations navigate the complexities of billing and reimbursement, proactive strategies and continuous monitoring are essential to minimize bad debt and improve cash flow.

Understanding the Importance

Key Metrics to Monitor

To effectively manage your A/R, tracking and analyzing key metrics is essential, including:

Aging of accounts receivable: This report categorizes outstanding balances by the time they have been overdue, helping you identify and prioritize accounts for follow-up. Closely monitoring aging reports allows you to proactively address delinquent accounts and prevent them from becoming bad debt.

Collection rate: This metric represents the percentage of total A/R collected within a specific period, indicating the effectiveness of your collection efforts. A high collection rate suggests efficient billing and follow-up processes, while a low rate may indicate the need for process improvements.

Denial rate: This measures the percentage of claims denied by payers, highlighting areas for improvement in billing and documentation processes. Analyzing denial trends can help you identify common reasons for denials and implement targeted strategies to reduce their occurrence.

Streamlining Billing and Collection Processes

Efficient and accurate billing processes are essential for minimizing denials and payment delays. You can improve communication with payers and patients by providing clear and timely invoices and statements. Ensure that your billing staff is well-trained in coding and documentation requirements to minimize the risk of errors and omissions that can lead to denials.

Leveraging Technology

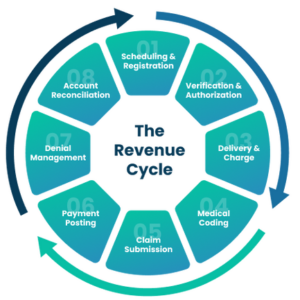

Technology solutions like revenue cycle management software and automated payment reminders can significantly enhance your A/R management efforts. These tools streamline processes, improve data accuracy, and provide real-time visibility into A/R performance, enabling you to make data-driven decisions and take proactive steps to optimize your revenue cycle.

Building a Skilled Team

A well-trained and motivated team dedicated to A/R management is crucial for success. A/R specialists play a vital role in following up on outstanding payments, resolving denials, and maintaining accurate records. Continuous training and development ensure your team stays updated on industry best practices and regulatory changes.

Outsourcing A/R Management: Pros and Cons

Outsourcing A/R management can offer several benefits, including access to specialized expertise, scalability, and cost savings. Partnering with a dedicated revenue cycle management company allows you to leverage their knowledge and resources to improve your A/R performance and focus on delivering quality patient care.

Best Practices for Maintaining Healthy A/R Levels

Maintaining healthy A/R levels involves implementing best practices such as regular monitoring, establishing clear policies and procedures, and fostering a culture of accountability. Regular audits of your A/R processes help identify areas for improvement and ensure compliance with industry regulations and payer requirements.

Develop and maintain strong relationships with payers, working collaboratively to resolve disputes and streamline reimbursement processes. Regularly review and update your billing and collection policies to reflect changes in industry standards and best practices.

Take Control of Your Revenue Cycle

Ineffective A/R management should not hinder your organization’s financial performance. Implementing the strategies outlined in this blog post and partnering with a trusted revenue cycle management solution like Titan Health allows you to take control of your revenue cycle and secure the reimbursement you deserve.